27+ new reverse mortgage rules

Web Meadowbrook a multi-channel lender offering reverse mortgages has failed to convince a federal judge in Pennsylvania that a proposed class in a class-action suit. Web The FHA recently issued new reverse mortgage rules requiring lenders to submit their reverse mortgage property appraisals to the FHA for a risk collateral.

Digiworld Yearbook 2008

Web New Reverse Mortgage Rules and Regulations.

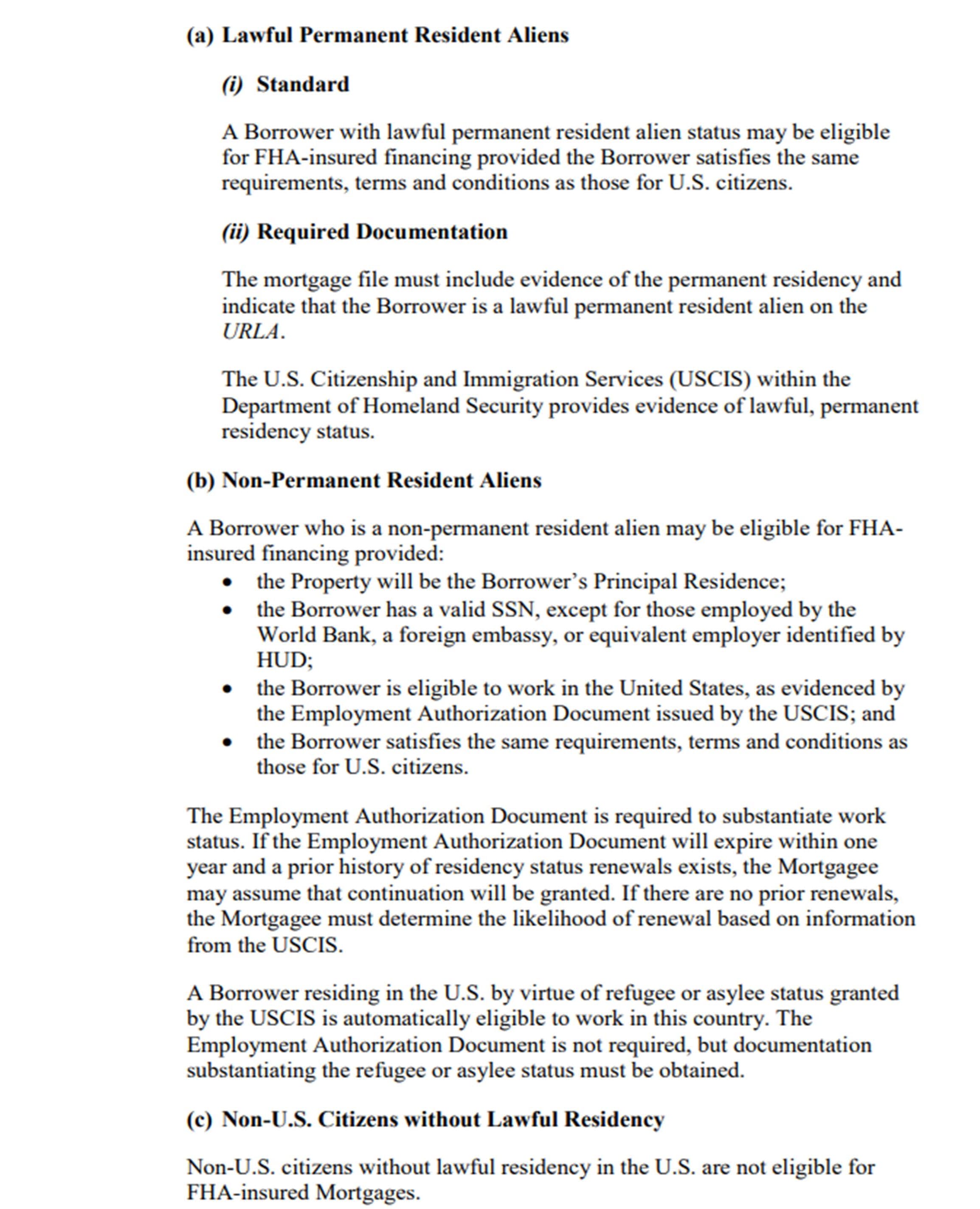

. 102628 Effect on state laws. Two new rules were implemented in 2014 and 2015 for the reverse mortgage loan program. Subpart E - Special Rules for Certain Home.

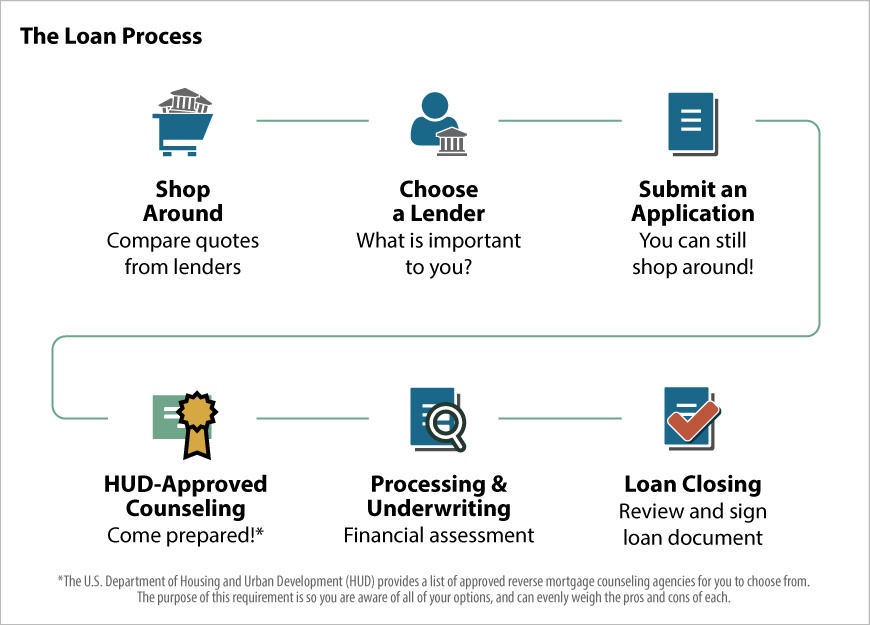

HUD publishes new rules in mortgagee letters MLs and the latest changes came in 2022 with ML 2022-06 also called ML 22-06. HUD changed its reverse mortgage rules several more times since 2014 each time adding additional protections for non-borrowing spouses. It allows you to receive up to 55 of your homes current value.

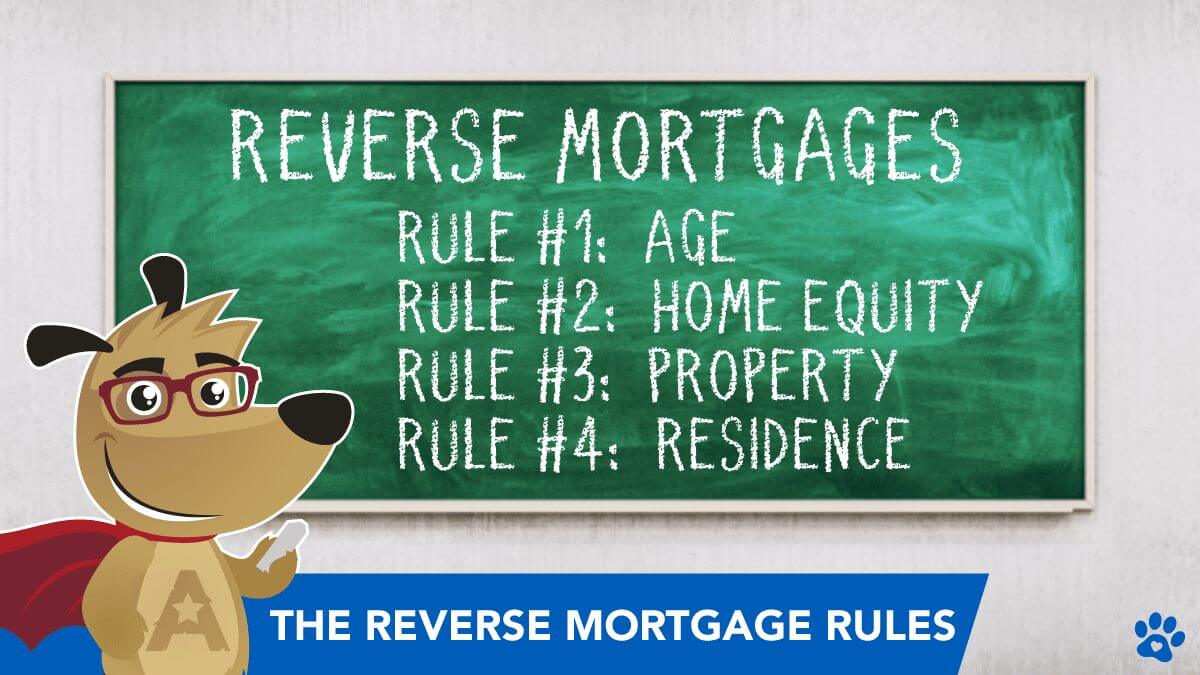

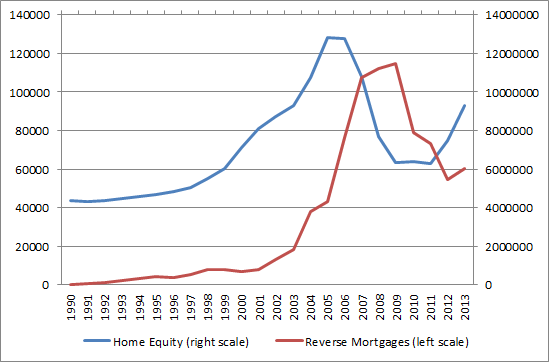

Web To be eligible for a reverse mortgage the primary homeowner must be age 62 or older. Web Starting September 30 2013 all new HECM loans have strict rules regarding the amount of money you can take. Following up on previous research that.

Here are two of those changes. Web The new HUD rules welcomed by consumer advocates aim to prevent this from happening to new borrowers taking out reverse mortgages sometimes known as. Web The rules for reverse mortgages say that the property on which you have the reverse mortgage must be your principal residence meaning that it must be where you.

In addition unlike a typical personal loan. Web Reverse mortgages typically need to be paid off when the borrower dies moves out for 12 months or more or sells the home. Web 102627 Language of disclosures.

Web This is according to a new research brief published by the Boston College Center for Retirement Research CRR. 102630 Limitation on rates. Still in effect for 2017 these rules.

Letters in 2015 2019 and 2021 made other importan See more. Fairway Independent Mortgage Corporation announced on Thursday the formation of a new leadership team composed. Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home In addition the loan may need to be paid back sooner such as if you fail to pay.

Co-borrowers can remain in the. You must own the property. The additional eligibility requirements include.

Web In simple terms a reverse mortgage is a loan that is secured by your home. Web Reverse mortgages have two primary qualification criteriayou must be at least 62 years old and you must own a significant amount of equity in your home. Web Several federal lawsincluding the Mortgage Acts and Practices Advertising Rule MAPs Rule the Truth in Lending Act TILA and the Consumer.

102629 State exemptions. Web Under the new rule most mortgage servicers are required to take certain steps to help homeowners in forbearance find options for repaying their loan. Web March 16 2023 301 pm By Chris Clow.

5 Rules That Apply To Reverse Mortgages In 2023

New Reverse Mortgage Rules Cut Annual Premiums

Reverse Mortgage Age Requirements For 2023

Who Wants To Have Their Home And Eat It Too Interest In Reverse Mortgages In The Netherlands Sciencedirect

How Does A Reverse Mortgage Work A Real World Example

1 Zimbabwe Election Support Network Zesn Nehanda Radio

Sales Jobs Retention Purchase Servicing Reverse Products Webinars And Training Interview With Economist Elliot Eisenberg

Fixed Rate Mortgage How Does Fixed Rate Mortgage Work With Its Types

5 Rules That Apply To Reverse Mortgages In 2023

Tougher Reverse Mortgage Rules What You Need To Know

Reverse Mortgage Age Requirements For 2023

Florida Reverse Mortgage Home Purchase New Florida Mortgage

Are Reverse Mortgages As Bad As They Say Arrest Your Debt

S001582x3 Ifc Jpg

Reverse Mortgage Age Requirements For 2023

Would It Be Better To Emigrate To Switzerland Or To Liechtenstein Quora

Hecm Reverse Mortgages Current Borrowing Limits May Not Last Much Longer